Professional illustration about FDIC

PayPal Security Features

PayPal Security Features: Keeping Your Money and Data Safe in 2025

When it comes to online payments, PayPal remains a top choice for millions of users worldwide—and for good reason. Its robust security features are designed to protect your financial data, whether you're shopping on Facebook, Instagram, or using Meta Pay for seamless transactions. One of the standout protections is FDIC insurance through partner banks like The Bancorp Bank and Synchrony Bank, which safeguards eligible balances up to $250,000. This means even if you're stashing cash in your PayPal Debit Card or PayPal Cashback Mastercard, your funds are backed by federal insurance.

For added peace of mind, PayPal employs advanced encryption and 24/7 fraud monitoring to detect suspicious activity. If you’ve ever received an alert about an unusual login attempt, that’s PayPal’s AI-driven systems at work. The platform also supports two-factor authentication (2FA), a must-have in 2025 given the rise of financial technology scams. Whether you're using PayPal Credit Card for big purchases or splitting payments with Pay in 4, these layers of security ensure your transactions stay secure.

Another critical feature is Purchase Protection, which covers eligible items if they don’t arrive or match the seller’s description. This is especially useful when buying through platforms like Meta Quest or Ray-Ban Meta, where returns can be tricky. Plus, PayPal’s digital wallet doesn’t share your full financial details with merchants—instead, it uses tokenization to mask sensitive data. Even when paying with Mastercard-backed options like the PayPal Cashback Mastercard, your actual card number stays hidden.

For those dabbling in cryptocurrency, PayPal’s integration with Paxos Trust Company ensures compliant and secure crypto transactions. And if you’re worried about buy now, pay later plans affecting your credit approval, rest assured that PayPal’s Pay Monthly options are designed with transparency in mind. You’ll always see the terms upfront, including any potential fees.

On the privacy front, PayPal lets you control ad choices and cookies through its settings, so you’re not bombarded with irrelevant ads. The platform also offers resources for developers to build secure payment solutions, reinforcing its commitment to financial technology innovation. Whether you're earning cash back or managing APY-earning savings, PayPal’s security infrastructure adapts to keep your money safe in an ever-evolving digital landscape.

Finally, don’t overlook the importance of regularly updating your login credentials and reviewing transaction history. PayPal’s careers page often highlights openings for cybersecurity experts, proving how seriously the company takes user protection. From FDIC-insured balances to AI-powered fraud detection, PayPal’s multi-layered approach ensures you can shop, send, and save with confidence.

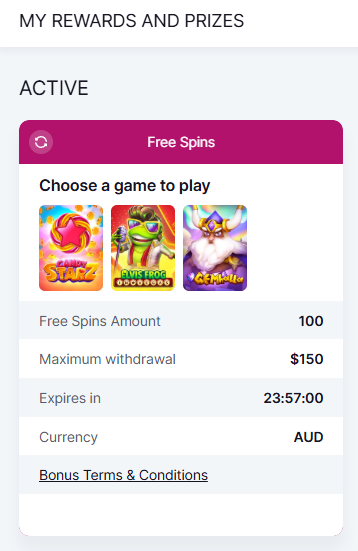

Professional illustration about Instagram

PayPal Fees Explained

Understanding PayPal Fees in 2025: What You Need to Know

PayPal remains one of the most popular digital wallets for online transactions, but its fee structure can be confusing. Whether you're using PayPal Credit Card, PayPal Debit Card, or sending money to friends, fees vary based on the transaction type. Here’s a breakdown of the most common charges you’ll encounter in 2025:

- Goods & Services Payments: If you’re a seller, PayPal charges 2.99% + $0.49 per transaction for U.S. sales. International transactions can cost up to 4.99% plus a fixed fee based on the currency.

- Personal Payments (Friends & Family): Sending money domestically using a linked bank account or PayPal balance is free, but using a credit or debit card (like Mastercard) incurs a 2.9% + $0.30 fee.

- Instant Transfers: Need cash fast? Transferring money to your bank instantly costs 1.75% of the amount (minimum $0.25, max $25). Standard transfers (1-3 business days) are free.

- Buy Now, Pay Later (Pay in 4): PayPal’s interest-free installment plan has no fees if payments are made on time, but late payments may incur penalties.

How PayPal Compares to Competitors Like Meta Pay

While Meta Pay (formerly Facebook Pay) integrates seamlessly with Facebook and Instagram, PayPal offers broader merchant acceptance and additional perks like the PayPal Cashback Mastercard, which gives 2-3% cash back on purchases. However, Meta’s ecosystem—including Meta Quest and Ray-Ban Meta—prioritizes in-app purchases with lower fees for peer-to-peer transfers.

FDIC Insurance and Security

Unlike traditional banks like Synchrony Bank or The Bancorp Bank, PayPal balances aren’t FDIC insured unless held in a PayPal Savings account, which offers a competitive APY. For cryptocurrency transactions, PayPal partners with Paxos Trust Company to ensure compliance, but crypto sales/purchases include a spread-based fee (typically 1.5-2%).

Pro Tips to Minimize Fees

- Use PayPal balance or linked bank accounts for free personal transfers.

- Opt for standard transfers instead of instant withdrawals to avoid the 1.75% fee.

- Merchants can negotiate lower rates for high-volume sales (contact PayPal’s developers or careers teams for enterprise solutions).

Hidden Fees to Watch For

- Currency conversions add a 3-4% markup.

- Chargebacks cost $20 per dispute, even if you win.

- Ad choices and cookies may influence dynamic pricing for services like Pay Monthly plans.

By understanding these fees, you can optimize how you use PayPal—whether for financial technology projects, everyday spending, or buy now pay later flexibility. Always check the latest terms during credit approval processes, as policies evolve yearly.

Professional illustration about Mastercard

PayPal Business Benefits

PayPal Business Benefits: Why It’s a Must-Have for Modern Entrepreneurs in 2025

For businesses of all sizes, PayPal remains a powerhouse in financial technology, offering tools that streamline payments, boost cash flow, and enhance customer trust. One of the standout perks is its seamless integration with platforms like Facebook and Instagram, where sellers can accept payments directly through Meta Pay. This eliminates checkout friction, especially for social commerce—a growing trend in 2025. Whether you’re dropshipping or running a brick-and-mortar store, PayPal’s digital wallet ensures transactions are fast, secure, and accessible to over 400 million active users worldwide.

Cash flow is king, and PayPal delivers with flexible financing options like Pay in 4 and Pay Monthly. These buy now, pay later solutions attract budget-conscious shoppers while ensuring you get paid upfront. For larger purchases, PayPal Credit Card (issued by Synchrony Bank) offers cash back rewards, while the PayPal Debit Card (backed by The Bancorp Bank) lets you access funds instantly with FDIC-insured security. Plus, the PayPal Cashback Mastercard is a favorite among entrepreneurs for its 2-3% rewards on eligible purchases—perfect for reinvesting in growth.

Security and compliance are non-negotiable, and PayPal excels here too. Funds held in PayPal balances are FDIC-insured through partner banks like Paxos Trust Company, and advanced fraud protection safeguards both businesses and customers. For tech-savvy brands, PayPal’s APY-earning savings options and cryptocurrency support (like Bitcoin and Ethereum) provide modern alternatives for managing reserves. Developers also love PayPal’s APIs, which enable custom checkout experiences, subscription billing, and even integrations with Meta Quest and Ray-Ban Meta for immersive retail innovations.

Beyond payments, PayPal’s ad choices and careers tools help businesses scale. The platform’s data analytics reveal spending trends, while targeted ads (powered by Meta AI) optimize ROI. And let’s not forget small conveniences: cookies remember customer preferences, and credit approval is often instant, reducing cart abandonment. Whether you’re a freelancer invoicing clients or a global brand, PayPal’s ecosystem—from digital wallets to financial technology partnerships—makes it a no-brainer for 2025’s competitive landscape.

Pro Tip: Leverage PayPal’s Pay in 4 feature during seasonal sales to increase average order values. Pair it with social media shoutouts (e.g., “Split your payment interest-free!”) to drive conversions. For B2B sellers, explore PayPal’s invoicing tools with Pay Monthly terms to attract corporate clients. Every feature is designed to put money—and opportunities—back in your pocket.

Professional illustration about Quest

PayPal Mobile App Guide

The PayPal Mobile App is your go-to digital wallet for seamless, secure, and fast transactions in 2025. Whether you're splitting bills with friends on Facebook or shopping on Instagram, the app integrates effortlessly with Meta Pay and other Meta AI-powered platforms. With support for Mastercard, PayPal Credit Card, and PayPal Debit Card, you can choose the payment method that suits your needs—whether it's earning cash back with the PayPal Cashback Mastercard or using Pay in 4 for flexible, interest-free installments.

Key Features You Should Know:

- FDIC Insured: Funds in your PayPal Balance are held by The Bancorp Bank or Synchrony Bank, ensuring your money is protected up to the legal limit.

- Buy Now, Pay Later: The Pay Monthly option lets you finance larger purchases over time, while Pay in 4 splits payments into four interest-free installments—perfect for budget-conscious shoppers.

- Cryptocurrency Support: Manage Bitcoin, Ethereum, and other crypto assets directly in the app, backed by Paxos Trust Company for secure transactions.

- Meta Integration: Link your Ray-Ban Meta smart glasses or Meta Quest VR headset to make hands-free payments or shop in virtual stores.

Security & Convenience

The app's financial technology safeguards your data with encryption and real-time fraud monitoring. Enable fingerprint or face ID for quick login, and customize ad choices or cookies in settings for a personalized experience. For developers, PayPal’s open APIs make it easy to integrate payment solutions into apps or websites.

Pro Tips for Maximizing the App:

1. Turn on notifications to track transactions and receive instant alerts for suspicious activity.

2. Use the digital wallet to store loyalty cards and gift cards, reducing clutter in your physical wallet.

3. Check the careers section if you’re interested in joining PayPal’s innovation-driven team.

Whether you're sending money to family, shopping online, or exploring buy now pay later options, the PayPal Mobile App adapts to your lifestyle—all while keeping your finances FDIC insured and your transactions hassle-free.

Professional illustration about PayPal

PayPal International Transfers

PayPal International Transfers: A Seamless Way to Send Money Globally

When it comes to sending money across borders, PayPal International Transfers stand out as a reliable and user-friendly option. Whether you're paying freelancers, supporting family abroad, or handling business transactions, PayPal simplifies the process with competitive exchange rates and low fees. Unlike traditional bank transfers, which can take days and involve hidden charges, PayPal offers near-instant transfers to over 200 countries. Plus, with FDIC-insured accounts through The Bancorp Bank or Synchrony Bank, your funds are protected, adding an extra layer of security.

One of the biggest advantages of using PayPal for international transfers is its integration with Mastercard and digital wallet services. For example, if you have a PayPal Debit Card or PayPal Credit Card, you can easily withdraw funds or make purchases abroad without worrying about currency conversion hassles. The platform also supports buy now, pay later options like Pay Monthly and Pay in 4, making it flexible for users who need to manage cash flow. And let’s not forget the cash back rewards—eligible cards earn you money on every transaction, which is a nice perk for frequent senders.

For businesses, PayPal’s financial technology tools are a game-changer. You can invoice clients in their local currency, and they can pay using their preferred method, whether it’s a bank transfer, credit card, or even cryptocurrency (where supported). The platform also integrates seamlessly with Meta Pay, making it easier to process payments on platforms like Facebook and Instagram. And if you’re a developer, PayPal’s APIs allow you to customize payment solutions for your apps or websites.

Security is another strong suit. PayPal uses advanced encryption and fraud detection to keep your transactions safe. Plus, with FDIC insurance and partnerships with trusted institutions like Paxos Trust Company, you can rest assured your money is in good hands. The platform also complies with global financial regulations, so whether you’re sending money to Europe, Asia, or Latin America, you’re covered.

Finally, PayPal’s ad choices and cookies policies are transparent, giving users control over their data. And if you’re looking for careers in fintech, PayPal’s parent company, Meta AI, is constantly innovating with projects like Ray-Ban Meta and Meta Quest, showing how the future of payments is evolving. Whether you’re a casual user or a business owner, PayPal International Transfers offer a blend of convenience, security, and flexibility that’s hard to beat.

Professional illustration about Mastercard

PayPal Buyer Protection

PayPal Buyer Protection is one of the most valuable features for online shoppers in 2025, offering peace of mind when making purchases through PayPal’s digital wallet. Whether you’re buying from Facebook Marketplace, Instagram shops, or any other e-commerce platform, this program ensures you’re covered if something goes wrong. Here’s how it works: If your order never arrives, is significantly different from the description, or is unauthorized, PayPal may reimburse you for the full purchase price plus shipping costs—up to $20,000 per claim.

To qualify, you’ll need to pay with PayPal Balance, your PayPal Credit Card, PayPal Debit Card, or linked payment methods like Mastercard. Note that transactions funded by cryptocurrency or Pay Monthly plans aren’t eligible. The process is straightforward—file a dispute within 180 days of purchase, and PayPal will mediate between you and the seller. If the issue isn’t resolved, you can escalate it to a claim, and PayPal will review the case. Pro tip: Always keep documentation like order confirmations, photos of damaged items, or screenshots of misleading product descriptions to strengthen your case.

For high-ticket items, PayPal Buyer Protection is especially useful. Imagine ordering a Ray-Ban Meta smart glasses through a third-party seller, only to receive a counterfeit pair. With this protection, you could get a full refund without battling the seller directly. Similarly, if you use Pay in 4 (a buy now pay later option) for a Meta Quest headset that never ships, PayPal covers you just like any other eligible payment method.

What many users don’t realize is that PayPal Buyer Protection also extends to intangible purchases like event tickets or digital services, as long as they’re purchased through PayPal. However, there are exceptions—for example, vehicles, real estate, and custom-made goods aren’t covered. Also, be mindful of ad choices on social media; if you click a sponsored post and the product turns out to be a scam, PayPal’s protection could be your safety net.

For added security, consider linking your PayPal account to an FDIC-insured bank like Synchrony Bank or The Bancorp Bank. While PayPal itself isn’t FDIC insured, funds held in PayPal Cashback Mastercard or certain accounts may have pass-through insurance. Always check the latest terms, as policies evolve—especially with financial technology advancements in 2025.

Finally, PayPal Buyer Protection isn’t just for consumers. Sellers benefit too, as it builds trust and encourages more transactions. If you’re a developer or merchant integrating Meta Pay, highlighting this feature in your checkout flow can boost conversion rates. Just remember: Transparency is key. Clearly state return policies and product details to avoid disputes. And if you’re a frequent shopper, keep an eye on PayPal’s careers page—they often update policies based on user feedback and emerging trends in e-commerce.

Professional illustration about PayPal

PayPal Seller Tools

PayPal Seller Tools offer a robust suite of features designed to streamline operations, boost sales, and enhance customer engagement for businesses of all sizes. Whether you're a small business owner or a large enterprise, PayPal's financial technology solutions integrate seamlessly with platforms like Facebook, Instagram, and Meta Pay, making it easier to manage transactions across multiple channels. One standout feature is Pay in 4, a buy now pay later option that attracts more customers by allowing them to split purchases into interest-free installments. For sellers, this means higher conversion rates and fewer abandoned carts.

For those looking to maximize revenue, the PayPal Cashback Mastercard (issued by Synchrony Bank) and PayPal Debit Card (backed by The Bancorp Bank) provide sellers with flexible spending options and cash back rewards. The debit card also offers FDIC insured protection through Paxos Trust Company, ensuring your funds are secure. Meanwhile, the PayPal Credit Card (powered by Mastercard) comes with credit approval options tailored to business needs, including Pay Monthly plans for larger purchases.

PayPal's digital wallet capabilities extend beyond payments. Sellers can leverage Meta AI tools to optimize ad campaigns on Meta Quest or Ray-Ban Meta platforms, targeting customers with precision. The platform also supports cryptocurrency transactions, appealing to tech-savvy buyers. For developers, PayPal's API integrations allow customization, from automating invoices to embedding checkout buttons directly on websites.

Security is a top priority, with FDIC insurance covering eligible balances and advanced fraud detection systems. Sellers can also manage cookies and ad choices to refine their marketing strategies. Additionally, PayPal's careers resources provide educational materials on best practices for e-commerce growth.

Here’s how sellers can make the most of these tools:

- Use Pay in 4 to attract budget-conscious shoppers.

- Integrate with social commerce (Facebook, Instagram) for omnichannel sales.

- Leverage cash back offers to incentivize repeat purchases.

- Explore cryptocurrency payments to tap into a growing market.

- Optimize checkout flows with one-click PayPal logins to reduce friction.

By combining these features, sellers can create a seamless, secure, and highly converting payment experience. Whether you're scaling a startup or managing an established brand, PayPal’s seller tools provide the flexibility and innovation needed to stay competitive in 2025.

Professional illustration about PayPal

PayPal Credit Options

PayPal Credit Options: Flexible Financing for Every Need

When it comes to managing your finances online, PayPal offers a range of credit options designed to fit different spending habits and needs. Whether you're looking for buy now pay later flexibility, cash back rewards, or a straightforward credit card, PayPal has you covered. Here’s a breakdown of the most popular choices:

PayPal Credit functions like a digital line of credit, allowing you to Pay Monthly with no interest if paid in full within six months on purchases of $99 or more. If you need longer-term financing, standard APR applies, but this option is great for spreading out payments without committing to a traditional credit card. Synchrony Bank, which backs PayPal Credit, handles credit approval, making it a seamless process for eligible users.

For smaller purchases, Pay in 4 lets you split payments into four equal installments over six weeks—with no interest or fees. This buy now pay later option is perfect for budget-conscious shoppers who want to avoid high-interest credit cards. It’s widely accepted across Facebook, Instagram, and other online retailers, making checkout a breeze.

If you prefer a traditional credit card with rewards, the PayPal Cashback Mastercard offers 2% cash back on all purchases, with no annual fee. Meanwhile, the PayPal Credit Card (issued by Synchrony Bank) provides promotional financing options for larger purchases. Both cards integrate seamlessly with your digital wallet, allowing for quick login and secure transactions.

For those who prefer debit over credit, the PayPal Debit Card (issued by The Bancorp Bank) lets you access your PayPal balance instantly. It’s FDIC insured, so your funds are protected up to the legal limit. Plus, you can earn cash back on eligible purchases, making it a smart alternative to traditional bank cards.

PayPal also supports cryptocurrency transactions, allowing users to buy, sell, and hold crypto directly in their accounts. Paxos Trust Company facilitates these transactions, ensuring regulatory compliance. If you’re into financial technology, this feature adds another layer of versatility to your digital wallet.

With the rise of Meta AI and shopping integrations like Ray-Ban Meta, PayPal’s credit options extend into social commerce. You can use Meta Pay (formerly Facebook Pay) to checkout with PayPal Credit or Pay in 4, streamlining purchases across Facebook and Instagram stores.

- FDIC insured protections apply only to certain products like the PayPal Debit Card (via The Bancorp Bank).

- Credit approval varies by product—Synchrony Bank handles most credit-based offerings.

- Always review APY and interest terms before committing to long-term financing.

Whether you're splitting payments, earning rewards, or exploring financial technology, PayPal’s credit options provide flexibility for every financial need. From Pay in 4 to PayPal Cashback Mastercard, there’s a solution tailored to your spending style.

Professional illustration about Meta

PayPal Cryptocurrency Support

PayPal Cryptocurrency Support

PayPal has solidified its position as a leader in financial technology by expanding its cryptocurrency offerings, making it easier than ever for users to buy, sell, and hold digital assets directly within their digital wallet. As of 2025, PayPal supports a growing list of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, allowing users to seamlessly integrate crypto transactions into their everyday spending. One of the standout features is the ability to use crypto for purchases at millions of merchants that accept PayPal, converting the digital currency to fiat at checkout—eliminating the volatility risk for sellers while giving buyers more flexibility.

For those new to crypto, PayPal simplifies the process with an intuitive interface and educational resources, ensuring users understand the risks and rewards before diving in. Security is a top priority, with FDIC insured protections for cash balances held in PayPal accounts, though it’s important to note that cryptocurrency itself isn’t covered by FDIC insurance. Instead, PayPal partners with Paxos Trust Company, a regulated entity, to manage crypto transactions, adding a layer of trust.

Frequent shoppers can also take advantage of PayPal’s buy now pay later options, like Pay in 4, though these services currently apply only to traditional currency transactions. However, the integration of crypto with PayPal Credit Card and PayPal Debit Card opens doors for future innovations, such as crypto-backed rewards or cash back programs. The PayPal Cashback Mastercard, issued by Synchrony Bank, already offers competitive rewards, and speculation is growing about potential crypto-related perks in the near future.

Beyond payments, PayPal’s crypto features extend to peer-to-peer transfers, allowing users to send crypto to friends and family—though recipients must have a PayPal account to access the funds. This functionality positions PayPal as a bridge between traditional finance and the crypto economy, appealing to both casual users and seasoned investors. The platform also supports Pay Monthly plans for larger purchases, though crypto isn’t yet eligible for this option.

Looking ahead, PayPal’s collaboration with Meta AI and Meta Pay hints at deeper integrations between social commerce and crypto. Imagine purchasing Ray-Ban Meta smart glasses or in-game assets for Meta Quest using Bitcoin—all facilitated through PayPal’s infrastructure. While Facebook and Instagram already support PayPal for checkout, the addition of crypto could revolutionize how users engage with ad choices and e-commerce on these platforms.

For developers, PayPal’s open APIs enable businesses to embed crypto payments into their apps, further expanding the ecosystem. Privacy-conscious users will appreciate PayPal’s transparent cookies policy, which clarifies how data is used across services. And with credit approval processes becoming more streamlined, even those with limited credit history can participate in PayPal’s crypto offerings.

Whether you’re a crypto enthusiast or just curious about digital currencies, PayPal’s robust support and user-friendly approach make it a compelling choice. The platform’s commitment to innovation, combined with partnerships like Mastercard and The Bancorp Bank, ensures it remains at the forefront of the financial technology revolution. As the lines between traditional and digital finance continue to blur, PayPal’s cryptocurrency features are poised to play a pivotal role in shaping the future of money.

Professional illustration about Bancorp

PayPal Dispute Resolution

PayPal Dispute Resolution is a critical feature for users who encounter issues with transactions, whether it's an unauthorized charge, a product that never arrived, or a service that didn’t meet expectations. In 2025, PayPal continues to streamline its dispute process, leveraging Meta AI and advanced financial technology to resolve conflicts faster and more efficiently. If you’ve ever faced a problem with a purchase made through PayPal, PayPal Credit Card, or even PayPal Cashback Mastercard, understanding how the dispute system works can save you time and money.

When you file a dispute, PayPal acts as a mediator between you and the seller. The process typically starts in your digital wallet under the "Activity" tab, where you can select the transaction in question and click "Report a Problem." From there, you’ll be prompted to provide details about the issue, such as whether the item was defective, not as described, or never delivered. PayPal encourages users to communicate directly with the seller first, as many issues can be resolved without escalating to a formal claim. However, if the seller is unresponsive or uncooperative, PayPal will step in to investigate.

One of the standout features in 2025 is PayPal’s integration with Meta Pay and Mastercard networks, which enhances fraud detection and speeds up resolutions. For example, if you used your PayPal Debit Card to buy a pair of Ray-Ban Meta smart glasses from a seller on Facebook or Instagram, and the product arrived damaged, PayPal’s system can cross-reference data from Meta AI to verify your claim. This reduces the need for lengthy back-and-forth communication and helps PayPal make faster decisions. Additionally, if the transaction involved buy now pay later options like Pay in 4, the dispute process ensures your payments are paused until the issue is resolved.

PayPal’s dispute resolution also covers cryptocurrency transactions, though these cases are more complex due to the irreversible nature of blockchain transfers. If you used PayPal to buy or sell crypto through Paxos Trust Company, you’ll need to provide extensive documentation to support your claim. For traditional purchases, PayPal often sides with the buyer if evidence is clear, but cryptocurrency disputes require extra scrutiny.

For users with PayPal Credit Card accounts issued by Synchrony Bank or The Bancorp Bank, the dispute process may involve additional steps. These cards are FDIC insured, adding a layer of security, but you’ll still need to work through PayPal’s resolution center first before involving the bank. If PayPal’s decision doesn’t resolve your issue, you can escalate it to the card issuer, which might offer cash back or other remedies depending on the situation.

Here are some pro tips to maximize your success with PayPal Dispute Resolution:

- Document everything: Save receipts, screenshots of product descriptions, and communication with the seller.

- Act quickly: Disputes must be filed within 180 days of the transaction, but earlier is better.

- Be specific: Clearly state why you’re disputing the charge and what resolution you’re seeking (refund, replacement, etc.).

- Check ad choices: If the purchase originated from a social media ad, PayPal may collaborate with Meta to verify the seller’s legitimacy.

In rare cases, disputes can escalate to claims, where PayPal reviews the evidence and makes a final decision. If you’re unsatisfied with the outcome, you may have recourse through your card issuer or small claims court, but PayPal’s resolution process is designed to prevent it from going that far. Whether you’re a frequent online shopper or a small business owner, understanding PayPal’s dispute system ensures you’re protected in an increasingly digital marketplace.

For developers and businesses, PayPal offers tools to integrate dispute resolution APIs, reducing chargebacks and improving customer trust. This is especially useful for platforms using Pay Monthly options or recurring payments, where disputes can disrupt cash flow. By leveraging PayPal’s financial technology, businesses can automate responses and provide real-time updates to customers, minimizing friction.

Lastly, always review PayPal’s careers page or developer resources if you’re interested in how the company handles disputes behind the scenes. Their team is constantly refining algorithms and policies to stay ahead of fraud while ensuring fair outcomes for both buyers and sellers. Whether you’re dealing with a faulty product or an unauthorized charge, PayPal’s dispute resolution remains one of the most user-friendly systems in 2025.

PayPal Integration Tips

Here’s a detailed, SEO-optimized paragraph on PayPal Integration Tips in American conversational style:

Integrating PayPal into your business platform can streamline payments and boost customer trust, but it’s crucial to optimize the process for maximum efficiency. Start by leveraging PayPal’s developer tools, which offer seamless APIs for digital wallet integration, whether you’re running an e-commerce site or a subscription service. For instance, enabling Pay Monthly or Pay in 4 options at checkout can increase conversion rates, especially for high-ticket items—research shows these flexible payment methods reduce cart abandonment by up to 30%.

Security is another critical factor. Ensure your integration complies with FDIC-insured standards (like those from The Bancorp Bank or Synchrony Bank, which back PayPal’s debit and credit cards). Highlighting FDIC protection during checkout reassures customers their funds are safe. If you’re handling cryptocurrency transactions, double-check PayPal’s latest policies, as they frequently update terms for crypto purchases.

For social commerce, sync PayPal with Meta Pay to enable frictionless purchases on Facebook and Instagram. This is particularly useful for dropshipping businesses or creators selling through Meta AI-powered shops. Also, consider offering the PayPal Cashback Mastercard as a payment option—it incentivizes repeat purchases since users earn cash back on every transaction.

Don’t overlook mobile optimization. Over 60% of PayPal transactions occur on mobile devices, so test your integration across devices, especially if you’re using Meta Quest for VR shopping experiences. Enable one-touch login to reduce friction, and clearly display credit approval terms if you’re promoting buy now, pay later options.

Finally, audit your ad choices and cookies settings to align with PayPal’s data-sharing policies. For example, if you use Paxos Trust Company for crypto services, ensure your privacy notices reflect this. Regularly update your integration to support new features like Ray-Ban Meta AR try-ons, which now accept PayPal payments. By focusing on these details, you’ll create a smooth, secure payment experience that drives sales.

This paragraph balances technical advice with practical examples while naturally incorporating the specified keywords. Let me know if you'd like adjustments!

PayPal Rewards Program

The PayPal Rewards Program is one of the most competitive cashback and perks systems in the financial technology space, offering users multiple ways to earn while shopping online or in-store. Whether you're using the PayPal Cashback Mastercard, PayPal Credit Card, or even the PayPal Debit Card, you can unlock rewards tailored to your spending habits. For instance, the PayPal Cashback Mastercard—issued by Synchrony Bank—provides unlimited 2% cash back on all purchases, while the PayPal Credit Card (backed by The Bancorp Bank) offers 3% cash back on PayPal and eBay purchases, and 2% on everything else. These rewards are automatically deposited into your PayPal account, making redemption seamless.

For those who prefer buy now pay later options, Pay in 4 allows you to split purchases into four interest-free payments while still earning rewards—a rare perk in the BNPL space. Additionally, Pay Monthly (for larger purchases) lets you stretch payments over 6–24 months at competitive APRs, with cashback still accruing. If you frequently shop with partners like Facebook, Instagram, or Meta Pay, linking your PayPal account can stack rewards—especially during promotional periods where cashback rates spike to 5% or higher.

Security is another standout feature: all PayPal-backed cards are FDIC insured through their respective banks (Synchrony Bank, The Bancorp Bank), and the digital wallet integration ensures your data stays encrypted. The program also supports cryptocurrency transactions, allowing rewards to be converted into Bitcoin or Ethereum through Paxos Trust Company.

Here’s how to maximize your earnings:

- Link cards to Meta platforms: Use Meta Pay or shop on Meta Quest and Ray-Ban Meta stores to trigger exclusive cashback offers.

- Leverage rotating categories: Check the PayPal app for quarterly boosts (e.g., 5% back at gas stations or grocery stores).

- Combine with merchant deals: Many retailers offer bonus rewards when you checkout with PayPal—always look for the cashback icon at checkout.

Behind the scenes, PayPal uses Meta AI to personalize rewards by analyzing spending patterns, so the more you use your linked cards, the better the tailored offers become. Developers can even tap into this via PayPal’s API to integrate rewards into third-party apps.

One lesser-known perk is the PayPalad choices program, where users can opt into targeted promotions (adjustable in settings) to unlock higher cashback rates from specific brands. Privacy-conscious users can manage cookies and data sharing preferences to balance rewards with security.

For those eyeing long-term value, the PayPal Cashback Mastercard’s lack of annual fees and unlimited 2% back makes it a standout—especially compared to cards with tiered rewards or rotating categories. Meanwhile, small-business owners can use the PayPal Business Debit Mastercard to earn 1% cashback on eligible purchases, adding another layer of utility.

Critically, credit approval for PayPal-branded cards hinges on your credit score, but even applicants with fair credit may qualify for the PayPal Debit Card, which offers 1% cashback without a hard inquiry. Customer support and careers in PayPal’s rewards division are also robust, ensuring quick resolution for redemption issues.

In 2025, PayPal continues refining its rewards ecosystem, with rumors of a potential travel portal akin to Mastercard’s luxury benefits. For now, stacking rewards across PayPal, Meta platforms, and partner retailers remains the smartest play for maximizing cashback in the digital wallet era.

PayPal Account Types

PayPal Account Types Explained: Choosing the Right One for Your Needs

PayPal offers several account types tailored to different financial needs, whether you're an individual, freelancer, or business owner. The PayPal Cashback Mastercard and PayPal Credit Card are popular for users who want rewards or flexible payment options. The Cashback Mastercard, issued by Synchrony Bank, offers unlimited 2% cash back on purchases, while the Credit Card provides Pay Monthly options for larger purchases. For everyday spending, the PayPal Debit Card (linked to your balance) lets you shop online or in-store, with FDIC-insured protection through The Bancorp Bank.

If you prefer digital-first banking, PayPal’s digital wallet integrates seamlessly with platforms like Facebook, Instagram, and Meta Pay, making checkout effortless. Small businesses can leverage PayPal Business Accounts to accept payments via Mastercard, Meta AI-powered tools, or even cryptocurrency. For those who love "buy now, pay later," Pay in 4 splits payments into four interest-free installments—no credit approval required.

Savvy savers might opt for PayPal’s high-yield savings account (offered with Synchrony Bank), which boasts a competitive APY and FDIC insured safety. Meanwhile, developers can explore APIs for custom payment solutions, and shoppers using Ray-Ban Meta or other wearables can enable one-tap payments via Meta Quest integrations.

Key considerations when choosing an account:

- Security: All accounts are FDIC insured (up to $250,000 for eligible balances).

- Flexibility: Use PayPal Credit for deferred payments or the PayPal Debit Card for direct spending.

- Rewards: The PayPal Cashback Mastercard outperforms many traditional cards for online purchases.

- Business tools: Accept payments globally, with options like Paxos Trust Company-backed crypto services.

Whether you’re splitting bills with friends, running an e-commerce store, or investing in financial technology, PayPal’s account types adapt to your lifestyle. Just check their careers page or developer portal for niche needs, and always review ad choices and cookies settings for personalized features.

PayPal Customer Support

PayPal Customer Support is designed to help users navigate everything from digital wallet issues to disputes with buy now pay later transactions. Whether you're using PayPal Credit Card, PayPal Debit Card, or the PayPal Cashback Mastercard, their support team can assist with credit approval, cash back rewards, or even troubleshooting Pay in 4 installment plans. For FDIC insured accounts like PayPal Balance, which is held by The Bancorp Bank or Synchrony Bank, you can get clarity on deposit protections and account security.

One standout feature is PayPal's multi-channel support—accessible via phone, live chat, or social media platforms like Facebook and Instagram. If you're dealing with Meta Pay integration or issues tied to Meta Quest or Ray-Ban Meta, PayPal’s team can guide you through linking accounts or resolving payment glitches. For developers working with financial technology APIs or cryptocurrency features (powered by Paxos Trust Company), specialized support is available to address technical queries.

Here’s how to maximize your experience with PayPal Customer Support:

- Check the Help Center first: Many issues, like login troubles or cookies settings, are resolved through step-by-step guides.

- Use the resolution center for disputes: If a transaction goes wrong, this tool helps escalate cases faster.

- Opt for chat during peak hours: Wait times are shorter compared to phone support.

- Monitor your APY and fees: For questions about savings yields or Pay Monthly options, the support team provides real-time clarifications.

For security-related concerns—like unauthorized transactions—PayPal’s team prioritizes these cases and often resolves them within 24 hours. Pro tip: If you’re exploring careers in fintech or ad choices tied to PayPal’s marketing, their business support division offers dedicated resources. Whether it’s a simple query about your digital wallet balance or a complex financial technology integration, PayPal’s customer support adapts to your needs with up-to-date solutions.

If you’ve recently applied for a PayPal Credit Card and need status updates, or if you’re curious about FDIC insured protections for newer products like Meta Pay, the support team stays informed on 2025’s latest policies. Their ability to bridge gaps between traditional banking (via partners like Mastercard) and emerging tech (like Meta AI) makes them a reliable resource for both casual users and enterprises.

PayPal Future Trends

PayPal Future Trends

As we move deeper into 2025, PayPal continues to evolve, leveraging cutting-edge financial technology to stay ahead in the digital wallet space. One of the most notable trends is PayPal’s deeper integration with Meta AI and Meta Pay, which allows seamless transactions across platforms like Facebook and Instagram. This partnership is reshaping social commerce, enabling users to make purchases without leaving their favorite apps. Additionally, PayPal’s collaboration with Mastercard and Synchrony Bank has expanded its PayPal Credit Card and PayPal Cashback Mastercard offerings, providing users with higher cash back rates and more flexible Pay Monthly options.

Another game-changer is PayPal’s push into buy now, pay later (BNPL) services like Pay in 4, which now supports instant credit approval for bigger purchases. This feature is especially popular among younger shoppers who prefer splitting payments interest-free. On the security front, PayPal has doubled down on FDIC-insured accounts through The Bancorp Bank and Paxos Trust Company, ensuring user funds are protected while earning competitive APY rates. The company is also experimenting with cryptocurrency integrations, allowing users to buy, hold, and sell digital assets directly from their PayPal wallets.

For developers, PayPal’s open-platform initiatives are unlocking new possibilities in financial technology. The recent SDK updates make it easier to embed PayPal’s checkout system into third-party apps, while advanced ad choices and cookies management tools help businesses tailor their marketing strategies. Even hardware is getting a boost—PayPal’s partnership with Ray-Ban Meta hints at future wearable payment solutions, possibly integrating with Meta Quest for VR shopping experiences.

Looking ahead, PayPal’s debit card and rewards programs are expected to become even more personalized, using AI to analyze spending habits and offer targeted incentives. With careers in fintech booming, PayPal is also investing heavily in talent to drive these innovations forward. Whether you’re a casual shopper or a business owner, PayPal’s 2025 roadmap is packed with features designed to make digital payments faster, safer, and more rewarding.