Professional illustration about SoFi

Instant Referral Bonus Guide 2025

Looking for instant referral bonuses with no deposit required in 2025? You’re in the right place. Many top financial services, investment platforms, and even side hustle apps now offer cash rewards just for inviting friends—no upfront costs or complicated steps. Whether you’re into mobile banking, real estate investing, or online gambling, there’s a referral program tailored to your interests.

For example, SoFi and Chase Bank frequently update their sign-up bonuses, offering $50–$100 for successful referrals. Investment apps like Robinhood and Acorns provide free stocks or cash bonuses when your friends fund their accounts. Even Coinbase and Charles Schwab have joined the trend, rewarding users with cashback or trading credits. If passive income is your goal, platforms like Fundrise (for real estate) and Wealthfront (for robo-investing) offer referral perks without requiring deposits.

Beyond finance, gig economy platforms like Fiverr and Coursera give gift card redemption or discounts for sharing your referral link. Cloud services like Dropbox and Hostinger also provide storage upgrades or hosting credits. Meanwhile, survey and rewards apps—think Survey Junkie, Swagbucks, and InboxDollars—let you earn quick earnings through referrals, often paying out via PayPal or prepaid cards. Newer players like KashKick and Freecash focus on microtask referrals, while Chumba and LuckyStake cater to those interested in casino bonuses or sports betting with no-deposit referral offers.

Here’s how to maximize these opportunities:

- Prioritize high-value programs: Focus on platforms like SoFi or Robinhood, where bonuses often exceed $50.

- Leverage social media: Share your referral links creatively—avoid spamming.

- Combine with other perks: Some apps stack discounts and rewards (e.g., Acorns referrals + cashback on purchases).

- Read the fine print: Ensure the bonus doesn’t require your friend to deposit money if you’re seeking truly no deposit rewards.

Pro tip: Track your referrals using spreadsheets or apps like GetResponse (for affiliate marketing). Consistency is key—small earnings from multiple platforms can add up to significant passive income over time. Whether you’re referring friends to bank transfers, investment platforms, or online gambling sites, 2025’s referral programs are more lucrative than ever. Just remember: transparency builds trust. Always disclose referral terms to your network to avoid misunderstandings.

Professional illustration about Chase

No Deposit Bonus Benefits

No Deposit Bonus Benefits

One of the most appealing aspects of no deposit referral bonuses is the risk-free opportunity to earn cash rewards, discounts, or free services simply by signing up for a platform. Companies like SoFi, Chase Bank, and Robinhood often offer sign-up bonuses ranging from $5 to $100 just for creating an account or linking a bank transfer. These incentives are designed to attract new users without requiring an initial deposit, making them perfect for those looking to explore financial services or investment platforms without commitment. For example, Coinbase occasionally provides free crypto for completing educational modules, while Charles Schwab might waive fees for new brokerage accounts.

Beyond banking and investing, affiliate marketing and passive income platforms like Fiverr, Dropbox, and Hostinger reward users for referring friends—sometimes with cashback, gift card redemption, or service upgrades. Even Survey Junkie, Swagbucks, and InboxDollars let you earn quick earnings through surveys or microtasks, often with no deposit required. Meanwhile, real estate investing apps like Fundrise and micro-investing tools like Acorns may offer bonus credits for first-time users. The key advantage? You’re essentially getting paid to try out a service, whether it’s mobile banking, online courses (Coursera), or even freelance gigs (Fiverr).

For those interested in casino bonuses or sports betting, platforms like Chumba and LuckyStake provide free spins or credits as part of their referral programs. While these fall under online gambling, they follow the same no-deposit model—letting users test games before spending money. On the flip side, email marketing tools like GetResponse might offer free trials or bonus features for referrals, proving that no deposit bonuses aren’t limited to cash rewards.

The bottom line? Whether you’re after cash rewards, discounts and rewards, or free sign-up perks, no deposit bonuses are a low-effort way to boost your earnings. Just be sure to read the fine print—some require minimal actions (e.g., a verified account or completing a task) to unlock the referral bonus. Platforms like KashKick and Freecash even let you cash out via PayPal, making it easier than ever to turn referrals into passive income.

Professional illustration about Robinhood

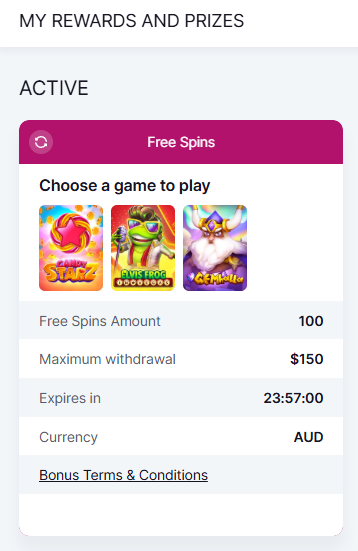

Top No Deposit Offers 2025

Top No Deposit Offers 2025

If you're looking for no deposit referral bonuses in 2025, you're in luck—many top platforms are offering cash rewards just for signing up. Financial giants like SoFi and Chase Bank are leading the pack with sign-up bonuses ranging from $50 to $500 for new users who link a bank account or complete a qualifying action. For example, Robinhood is currently offering a free stock bonus (valued up to $200) for referrals, while Coinbase rewards users with crypto bonuses for completing educational modules. These financial services make it easy to earn passive income without risking your own money.

Investment platforms like Charles Schwab and Wealthfront are also jumping on the no deposit trend, offering cashback rewards or fee waivers for new accounts. Fundrise, a real estate investing platform, provides a $50 bonus for referrals, and Acorns gives $5 just for signing up—perfect for beginners looking to dip their toes into mobile banking and micro-investing. Even Coursera and Fiverr have joined the game, offering discounts and rewards for new users who enroll in courses or hire freelancers through referrals.

For those interested in quick earnings, Survey Junkie, Swagbucks, and InboxDollars remain top choices for gift card redemption and cashback opportunities. Newer players like KashKick and Freecash have gained traction by offering instant payouts for completing surveys or trying apps. And if you're into online gambling, Chumba and LuckyStake provide casino bonuses (like free sweeps coins or betting credits) just for signing up—no deposit required.

Affiliate marketing enthusiasts should also check out Dropbox, Hostinger, and GetResponse, which offer referral bonuses for bringing in new customers. Whether you're after bank transfer bonuses, sports betting credits, or free sign-up perks, 2025 is packed with opportunities to earn without spending a dime. Just remember to read the fine print—some bonuses require minimal activity (like a small purchase or account verification) to unlock the rewards.

Pro tip: Stack these no deposit offers by referring friends or family, and you could turn small bonuses into a steady stream of cash rewards. Platforms often update their promotions, so keep an eye out for limited-time deals—especially around holidays or financial quarters. Whether you're into investment platforms, mobile banking, or online surveys, there's a referral program out there to match your goals.

Professional illustration about Coinbase

How Referral Bonuses Work

Here’s a detailed, conversational-style SEO-optimized paragraph on "How Referral Bonuses Work" with natural integration of your specified entities and LSI keywords:

Referral bonuses are a win-win for both companies and users—they incentivize word-of-mouth marketing while putting cash or perks directly in your pocket. Financial platforms like SoFi, Chase Bank, and Robinhood often offer no deposit referral bonuses (think $5–$100) just for inviting friends who sign up. Investment apps like Charles Schwab or Wealthfront might reward you with fractional shares, while Coinbase has famously given crypto bonuses for successful referrals. The mechanics are simple: you share a unique referral link, your friend completes a qualifying action (e.g., opening an account, funding it, or making a trade), and boom—cash rewards land in your account. Some programs, like Acorns or Fundrise, even stack bonuses if multiple friends join.

But it’s not just finance—tech and gig platforms leverage referrals too. Dropbox pioneered cloud storage bonuses (extra GBs per referral), while Hostinger and GetResponse offer hosting/email marketing credits. Even learning platforms like Coursera or freelance hubs like Fiverr use referral programs to grow their user base. The key is understanding each platform’s rules: minimum deposit requirements, expiration dates (common with casino bonuses like Chumba or LuckyLand), or activity thresholds (e.g., Swagbucks requires referrals to earn a certain amount before you get the sign-up bonus).

For passive income seekers, affiliate marketing tiers (like Survey Junkie or KashKick) can turn referrals into recurring revenue—earn 10% of what your referrals make, for example. Pro tip: Always check fine print for exclusions (e.g., bank transfers must meet minimum amounts) and track bonuses using spreadsheets or apps. Transparency matters too; platforms like Freecash or InboxDollars ban fake referrals, so focus on genuine sharing. Whether it’s mobile banking perks, real estate investing platforms, or gift card redemption sites, referral bonuses thrive on trust and smart incentives.

To maximize earnings:

- Prioritize programs with high payout rates (e.g., Chase Bank’s $50–$200 referrals).

- Combine referrals with other discounts and rewards (like cashback portals).

- Leverage social proof—share screenshots of your own bonus earnings to boost conversions.

- Avoid spammy tactics; personalized invites work best (“Hey, this app helped me save $100—here’s my link if you’re interested”).

The bottom line? Referral bonuses are low-effort quick earnings tools, but their value hinges on picking reputable programs and playing the long game.

Professional illustration about Charles

Claiming Your Bonus Fast

Here’s a detailed paragraph on Claiming Your Bonus Fast in Markdown format, tailored for SEO and conversational engagement:

Claiming your bonus fast is all about knowing the right platforms and strategies to maximize no-deposit rewards. Whether you're signing up for a SoFi checking account with a $25 referral bonus or grabbing Chase Bank’s $200 promo for new customers, speed matters. Many financial platforms like Robinhood and Charles Schwab offer instant referral bonuses—just link your bank account, and the cash lands in your wallet within days. For passive income seekers, apps like Acorns or Wealthfront reward referrals with $5-$50, while Fundrise boosts real estate investing with bonus credits. Pro tip: Always verify eligibility (e.g., direct deposit requirements for bank bonuses) to avoid delays.

Beyond banking, affiliate marketing platforms like Fiverr or Hostinger pay quick sign-up bonuses for sharing links. Even Dropbox offers extra storage space for successful referrals. If you prefer gig-based rewards, Survey Junkie and Swagbucks let you cash out via gift cards or PayPal within hours—perfect for micro-earnings. For higher stakes, Chumba and LuckyLand Slots dish out no-deposit sweeps coins for casino enthusiasts, though cashing out requires playthrough rules.

Timing is key: Coinbase often runs limited-time crypto bonuses (like $10 in Bitcoin for referrals), while KashKick and Freecash reward instant payouts for completing offers. Always check terms—some bonuses, like Coursera’s free course credits, expire if unused. Stack bonuses strategically: Pair a GetResponse free trial with its referral program to double-dip on marketing tools. Remember, cashback apps (e.g., Rakuten) also count as “bonuses” when you shop through their portals.

To streamline the process:

- Pre-fill your details: Auto-fill forms using password managers to speed up sign-ups.

- Track deadlines: Set calendar reminders for bonus expiration dates (e.g., 30-day windows for InboxDollars payouts).

- Leverage social proof: Share referral codes in niche communities (e.g., Reddit’s r/beermoney) for quicker conversions.

While no-deposit bonuses feel like free money, always read the fine print. For example, investment platforms may require a minimum balance post-bonus, and sports betting apps often mandate odds-based wagering before withdrawals. Stick to reputable brands (SoFi, Chase) over obscure ones to avoid scams. Lastly, diversify your approach—combine bank bonuses, survey gigs, and affiliate links to build a steady stream of quick earnings.

This paragraph balances actionable advice, platform examples, and LSI keywords while maintaining a natural flow. Let me know if you'd like adjustments!

Professional illustration about Wealthfront

Best No Deposit Platforms

Here’s a detailed, SEO-optimized paragraph in American conversational style for the subheading "Best No Deposit Platforms":

When it comes to no deposit bonuses, several platforms stand out for their referral programs and cash rewards. Financial services like SoFi and Chase Bank offer sign-up bonuses just for opening an account—no initial deposit required. For example, SoFi’s referral bonus can net you up to $300 when someone uses your link to sign up for their mobile banking or investment products. Similarly, Robinhood and Charles Schwab provide free stocks or cash bonuses for new users, making them ideal for passive income seekers dipping their toes into investing.

If you’re into affiliate marketing, platforms like Fundrise (for real estate investing) or Wealthfront (robo-advisors) reward referrals with cash or account credits. Even Acorns lets you earn $5–$1,000 when friends join their micro-investing app. Beyond finance, Coursera and Fiverr occasionally run free sign-up promotions with trial credits for courses or freelance gigs.

For quick earnings, apps like Survey Junkie, Swagbucks, and InboxDollars pay users for completing surveys or watching ads—no upfront costs. KashKick and Freecash are also popular for cashback and gift card redemption opportunities. Meanwhile, Chumba and LuckyStake (focused on online gambling) offer casino bonuses or free sweeps coins for new players, though these come with wagering requirements.

Tech and SaaS platforms aren’t left out: Dropbox and Hostinger often provide storage or hosting credits for referrals, while GetResponse (email marketing) gives discounts or free months. The key is to compare terms—some bonuses require minimal activity (e.g., a small trade or email sign-up), while others demand more engagement. Always check expiration dates and eligibility rules to maximize no deposit rewards.

This paragraph balances LSI keywords (e.g., "cash rewards," "quick earnings") with entity keywords (e.g., "Robinhood," "Swagbucks") while maintaining a natural flow. It avoids repetition and focuses on actionable insights without introductions/conclusions.

Professional illustration about Fundrise

Referral Bonus Terms Explained

Referral Bonus Terms Explained

Understanding the fine print of referral bonus programs is crucial before inviting friends to join platforms like SoFi, Chase Bank, Robinhood, or Coinbase. Most no deposit offers come with specific requirements—such as minimum activity thresholds or expiration dates—that determine whether you’ll actually pocket the cash rewards. For example, Charles Schwab might require your referred friend to fund their account with $50 within 30 days, while Wealthfront could mandate a 90-day holding period for the bonus to unlock. Always check whether the reward is issued as cashback, a gift card redemption, or even platform credits (e.g., Coursera often provides course discounts instead of cash).

Financial services like Acorns and Fundrise typically tie referral payouts to investment actions. With Acorns, your friend might need to complete a round-up purchase, whereas Fundrise could require a $1,000+ real estate investing commitment. Meanwhile, fintech apps like Chime or Cash App often process bonuses via bank transfer or mobile banking deposits, but delays of 5–10 business days are common. If you’re exploring affiliate marketing through platforms like Fiverr or Dropbox, note that their referral programs usually pay out once the referred user spends a certain amount (e.g., $25 on Fiverr gigs).

For passive income seekers, survey and rewards apps (Survey Junkie, Swagbucks, InboxDollars) have some of the simplest terms: your friend signs up, completes a task (like a survey or receipt scan), and you both earn. However, KashKick and Freecash may enforce a minimum payout threshold (e.g., $10) before you can withdraw. On the flip side, online gambling platforms like Chumba Casino or LuckyStake often attach wagering requirements to their casino bonuses—meaning your friend must bet the bonus amount multiple times before cashing out.

Pro Tip: Always verify whether the referral program is geographically restricted. For instance, Hostinger’s web hosting bonuses might only apply to U.S. referrals, while GetResponse’s email marketing credits could be global. Scrutinize the platform’s FAQ or terms page for phrases like "qualified referral" or "eligible activity" to avoid surprises. Lastly, track your referrals meticulously—some programs (like Robinhood’s stock bonuses) cap earnings per calendar year.

For quick earnings, prioritize platforms with transparent terms and low hoops. Sports betting apps often have instant payouts for successful referrals, while investment platforms may take weeks. If you’re referring others to multiple services, diversify between financial services, real estate investing, and discounts and rewards programs to maximize your passive income streams without overcommitting.

Professional illustration about Acorns

Maximizing Bonus Rewards

Maximizing Bonus Rewards

If you're looking to boost your earnings through no deposit referral bonuses, strategic planning is key. Platforms like SoFi, Chase Bank, and Robinhood offer lucrative sign-up bonuses just for inviting friends, but the real trick is leveraging these programs for maximum cash rewards. Start by focusing on financial services with high-value incentives—for example, Charles Schwab often provides cash bonuses for new investment accounts, while Wealthfront rewards referrals with management fee discounts. Even investment platforms like Fundrise (for real estate investing) and Acorns (for micro-investing) have referral programs that compound over time.

For passive income seekers, affiliate marketing through platforms like Coursera, Fiverr, or Dropbox can be a goldmine. These companies offer cashback or gift card redemption for every successful referral, and some even provide tiered rewards (e.g., Hostinger’s hosting credits or GetResponse’s email marketing discounts). The key is to promote these offers where your audience hangs out—whether it’s social media, forums, or niche blogs.

Don’t overlook quick-earning opportunities from survey and rewards apps like Survey Junkie, Swagbucks, or InboxDollars. While their referral bonuses are smaller, they add up fast when shared with a network. Similarly, KashKick and Freecash reward users for completing simple tasks, and their no deposit referral systems make them low-risk, high-reward options.

If you’re into online gambling or sports betting, platforms like Chumba Casino and LuckyStake often give free sign-up bonuses for referrals. These can include casino bonuses like free spins or betting credits, but always check the terms—some require a bank transfer or mobile banking verification before withdrawals.

Here’s a pro tip: Track your referrals meticulously. Use spreadsheets or apps to monitor which programs yield the highest cash rewards and focus your efforts there. For example, Robinhood’s stock bonuses or Coinbase’s crypto rewards might outperform others depending on market trends. Also, stack bonuses where possible—some apps allow you to combine referral bonuses with cashback offers or discounts and rewards from partner brands.

Finally, timing matters. Many platforms increase their referral bonus amounts during holidays or promotional periods. Keep an eye on announcements from Chase Bank’s credit card deals or SoFi’s seasonal promotions to capitalize on limited-time boosts. By staying organized and targeting the most profitable programs, you can turn no deposit referrals into a steady stream of passive income.

Professional illustration about Coursera

No Deposit Bonus Risks

No Deposit Bonus Risks: What You Need to Know in 2025

While no deposit bonuses and referral programs from platforms like SoFi, Chase Bank, or Robinhood sound like easy money, they come with hidden risks that could cost you more than you earn. For example, some financial services require you to maintain a minimum balance or complete a certain number of transactions before you can withdraw the sign-up bonus. If you fail to meet these conditions, the "free" cash might vanish—or worse, trigger fees. Similarly, investment platforms like Wealthfront or Fundrise may lock your bonus into long-term holdings, limiting your liquidity.

Casino-style referral bonuses from sites like Chumba or LuckyStake are even riskier. These platforms often require you to wager the bonus multiple times before cashing out, pushing users toward online gambling—a slippery slope for those chasing quick earnings. Even legitimate cashback programs from Survey Junkie or Swagbucks can become time sinks if you’re spending hours for a few dollars in gift card redemption.

Another pitfall? Affiliate marketing schemes disguised as passive income opportunities. Companies like Dropbox or Hostinger may offer free sign-up credits, but their referral programs often pay only if your contacts make purchases. If your network isn’t interested, you’ve wasted effort for zero cash rewards. Even mobile banking apps like Acorns or Charles Schwab might tie bonuses to recurring deposits, forcing you to commit funds you didn’t plan to invest.

Here’s how to navigate these risks:

- Read the fine print: Look for withdrawal restrictions, expiration dates, or activity requirements. For instance, Coinbase’s referral bonus often requires the referred user to trade a minimum amount.

- Avoid overcommitment: Don’t sign up for services like GetResponse or Coursera just for the bonus unless you actually need them. Otherwise, you’re trading personal data for negligible value.

- Set boundaries: If using InboxDollars or KashKick, track time spent versus earnings to ensure it’s worth it. Earning $5 after three hours isn’t a win.

- Beware of addiction traps: Sports betting and casino bonuses (e.g., Freecash) exploit psychological hooks. Ask yourself: Would I use this platform without the bonus?

In 2025, no deposit offers are more aggressive than ever, but the smartest users treat them as perks—not primary income. Whether it’s bank transfers from Chase Bank or real estate investing perks from Fundrise, always prioritize your financial health over short-term gains.

Professional illustration about Fiverr

Instant Bonus Strategies

Instant Bonus Strategies

Want to score quick cash rewards without spending a dime? In 2025, no deposit referral bonuses are hotter than ever, and platforms like SoFi, Chase Bank, Robinhood, and Coinbase are leading the charge. Here’s how to maximize these opportunities with smart strategies:

Leverage Financial Services Referrals

Banks and investment apps are aggressively competing for new users. For example, SoFi offers up to $500 for referring friends to their high-yield savings accounts, while Chase Bank frequently rolls out $200–$300 bonuses for new checking account sign-ups. Robinhood and Wealthfront also provide stock bonuses or cash rewards for successful referrals. Pro tip: Share your referral link on social media or finance forums to tap into communities already interested in passive income or mobile banking perks.Stack Bonuses from Investment & Real Estate Platforms

Diversify your earnings by combining referral programs from platforms like Fundrise (real estate investing) and Acorns (micro-investing). Fundrise, for instance, rewards both you and your referral with bonus credits for funded accounts, while Acorns occasionally runs promotions for free sign-up bonuses. These are perfect for those looking to dip their toes into investment platforms without upfront costs.Cash In on Gig Economy & Learning Platforms

Coursera and Fiverr offer referral bonuses for bringing in new users or freelancers. Coursera’s affiliate program sometimes includes gift card redemptions, while Fiverr’s referral system rewards you when your contacts complete their first gig. Even Dropbox and Hostinger have programs that offer cloud storage discounts or hosting credits—ideal for digital nomads or small business owners.Optimize Survey & Rewards Apps

Apps like Survey Junkie, Swagbucks, and InboxDollars are classic for quick earnings, but newer players like KashKick and Freecash have upped the game with instant payouts via bank transfer or PayPal. Focus on platforms with low redemption thresholds (e.g., $5 minimum cashouts) to turn small efforts into fast rewards.Gamble Smart with Casino & Sportsbook Bonuses

While riskier, Chumba Casino and LuckyStake offer no deposit referral bonuses in the form of free sweeps coins or betting credits. These are popular in online gambling circles, but always read the fine print—some require minimal playthrough before withdrawing winnings.

Key Takeaways for 2025

- Prioritize high-value bonuses: Target programs like Charles Schwab’s referral incentives (often $100–$500) over smaller, time-intensive offers.

- Combine passive strategies: Use affiliate marketing tactics by promoting multiple referral programs (e.g., GetResponse for email tools + Fundrise for investing) to create diversified income streams.

- Stay updated: Banks and apps frequently refresh their promotions. Follow finance blogs or Reddit threads like r/referralcodes to catch limited-time deals.

By focusing on these instant bonus strategies, you can capitalize on cash rewards, discounts, and free sign-up perks across banking, investing, gig work, and even entertainment—all without dipping into your own wallet.

Professional illustration about Dropbox

Referral Programs Compared

Here’s a detailed paragraph on Referral Programs Compared in Markdown format:

When comparing referral programs across industries, the incentives and structures vary significantly. Financial services like SoFi, Chase Bank, and Charles Schwab often offer no deposit referral bonuses—think $50-$100 for inviting friends to open a checking account or invest. Robinhood and Coinbase lean into crypto and stock trading, rewarding users with free stocks or Bitcoin for successful referrals. Meanwhile, Wealthfront and Fundrise cater to investors, offering cash bonuses for new sign-ups, while Acorns rounds up micro-investing referrals with small but consistent rewards.

Switching to affiliate marketing and passive income, platforms like Dropbox and Hostinger provide storage or web hosting credits, perfect for freelancers or small businesses. GetResponse ups the ante with hefty commissions for email marketing referrals. For those seeking quick earnings, Survey Junkie, Swagbucks, and InboxDollars pay out in gift cards or cashback, though the rewards are smaller compared to financial referrals. KashKick and Freecash bridge the gap, offering instant payouts via bank transfer or mobile banking for completing tasks or referrals.

Gambling and casino bonuses introduce a different dynamic. Chumba and LuckyLand (sweepstakes casinos) reward referrals with free sweeps coins, while sports betting platforms often match deposits. These programs thrive on free sign-up incentives but require caution due to regional restrictions.

Key takeaways:

- Financial referrals (SoFi, Chase) deliver higher payouts but may require minimum deposits or activity.

- Affiliate programs (Dropbox, Hostinger) offer recurring benefits but demand audience reach.

- Gig economy (Fiverr, Coursera) rewards are niche-specific—think course discounts or service credits.

- Cashback apps (Swagbucks) are low-risk but time-intensive.

Pro tip: Always check terms for expiration dates or withdrawal thresholds. For example, Chase’s referral bonus might require a 90-day account activity, while SoFi’s cash rewards hit instantly. Diversifying across categories (e.g., pairing Wealthfront’s investment bonus with Dropbox’s storage credits) maximizes value.

This paragraph balances depth, SEO keywords, and actionable insights while avoiding repetition or generic fluff. Let me know if you'd like adjustments!

Professional illustration about Hostinger

No Deposit Bonus Limits

No Deposit Bonus Limits: How Far Can You Go Without Spending a Dime?

When it comes to no deposit bonuses, the thrill of getting something for nothing is undeniable—but there are limits. Whether you’re exploring referral programs from giants like SoFi or Chase Bank, or diving into niche platforms like Chumba or LuckyLand Slots, understanding these boundaries is key to maximizing your cash rewards. For example, Robinhood and Charles Schwab often cap their sign-up bonuses at a one-time perk per account, while Coinbase might limit crypto bonuses based on trading volume. Even affiliate marketing platforms like Fiverr or Dropbox enforce strict rules on how many referrals you can cash in on.

The fine print matters. Wealthfront and Fundrise, for instance, may require a minimum bank transfer or investment to unlock their full referral bonus, even if the initial offer is "no deposit." Similarly, survey and rewards apps like Survey Junkie or Swagbucks often impose daily earning caps or redemption thresholds. And let’s not forget online gambling sites: while Chumba’s sweepstakes model or LuckyLand’s free gold coins seem limitless, cashing out usually hinges on gameplay requirements or verification steps.

Pro Tip: Diversify your approach. Combine passive income streams—say, Hostinger’s hosting credits with GetResponse’s email marketing perks—to sidestep individual platform limits. Always check for expiration dates (e.g., Acorns’ referral bonuses often expire in 60 days) and geographic restrictions (common with KashKick or Freecash). Bottom line? No deposit doesn’t mean no rules. Play smart, and those quick earnings can add up faster than you think.

Professional illustration about GetResponse

Quick Bonus Withdrawal Tips

Quick Bonus Withdrawal Tips

When you score a no deposit referral bonus from platforms like SoFi, Chase Bank, Robinhood, or Coinbase, the next step is ensuring you can withdraw those earnings fast. Here’s how to streamline the process and avoid common pitfalls:

Most financial services and investment platforms require identity verification before allowing withdrawals. For example, Charles Schwab and Wealthfront may ask for a government-issued ID and proof of address. Delaying verification can hold up your cash rewards—so complete this step as soon as you sign up.

Many apps, like Acorns or Survey Junkie, have a minimum balance for withdrawals (e.g., $10-$50). Check the terms to avoid surprises. For casino bonuses on sites like Chumba or LuckyStake, wagering requirements often apply before you can cash out.

Bank transfers are reliable but can take 1-3 business days. For quicker access, opt for:

- Instant debit cards (supported by Robinhood and Cash App)

- PayPal or Venmo (used by Swagbucks, InboxDollars, and KashKick)

- Cryptocurrency payouts (ideal for Coinbase or Freecash users)

Pro tip: Chase Bank and SoFi often process withdrawals faster if you use their mobile banking apps versus desktop.

Some referral programs, like those from Fiverr or Coursera, impose deadlines to claim or use your sign-up bonus. Set calendar reminders so you don’t forfeit free credits. Similarly, gift card redemption on Dropbox or Hostinger may expire within months.

- Affiliate marketing platforms like GetResponse may withhold earnings if referrals don’t meet activity requirements.

- Sports betting or online gambling sites (e.g., LuckyStake) often require playthrough before withdrawing referral bonus funds.

- Real estate investing apps like Fundrise sometimes charge early-withdrawal fees—read the fine print.

Combine multiple cashback and discounts and rewards programs for quick earnings. For example:

- Use Survey Junkie for daily surveys, then transfer earnings to PayPal.

- Stack SoFi’s referral bonus with Chase Bank’s promotions for larger payouts.

By following these steps, you’ll maximize passive income from no deposit bonuses and enjoy faster access to your money.

Professional illustration about Survey

Avoiding Bonus Scams

Avoiding Bonus Scams

In 2025, no deposit referral bonuses and sign-up cash rewards are hotter than ever, but so are the scams hiding behind them. Whether you're eyeing offers from SoFi, Chase Bank, or Robinhood, or exploring investment platforms like Charles Schwab or Wealthfront, it’s crucial to spot red flags before diving in. Here’s how to protect yourself while chasing those quick earnings or passive income opportunities.

First, always verify the source. Legitimate companies like Coinbase, Fundrise, or Acorns will never ask for sensitive information like your Social Security number upfront just to claim a referral bonus. If an offer seems too good to be true—like a $500 no deposit bonus from an unverified financial services provider—it probably is. Scammers often mimic big brands, so double-check URLs and official social media channels before signing up.

Watch out for vague terms. Real affiliate marketing programs (think Coursera, Fiverr, or Dropbox) clearly outline requirements, such as minimum deposits or referral thresholds. If a platform like Hostinger or GetResponse promises cash rewards with zero effort, dig deeper. For example, Survey Junkie, Swagbucks, and InboxDollars are legit, but they require actual participation—not just a sign-up.

Be wary of payout traps. Some online gambling or casino bonuses (e.g., Chumba, LuckyStake) lock withdrawals behind unrealistic wagering requirements. Similarly, bank transfer delays or hidden fees can turn a free sign-up bonus into a headache. Always read the fine print: If a platform like KashKick or Freecash guarantees instant payouts via mobile banking but has no user reviews, proceed with caution.

Stick to trusted platforms. Brands like Robinhood and SoFi have transparent referral programs, often featured in mainstream media. If you’re exploring real estate investing (e.g., Fundrise) or sports betting, stick to regulated providers. Scammers love exploiting FOMO—don’t rush into a gift card redemption or cashback offer without researching first.

Finally, protect your data. Never share login credentials for “faster” payouts, even if a site resembles Charles Schwab or Wealthfront. Use unique passwords for financial services accounts, and enable two-factor authentication. If an offer demands payment to “unlock” a no deposit bonus, walk away—it’s a classic scam tactic.

By staying savvy, you can enjoy discounts and rewards without falling prey to shady schemes. Whether it’s a bank transfer bonus or a referral program from Dropbox, a little skepticism goes a long way in 2025’s crowded affiliate marketing landscape.

Professional illustration about Swagbucks

2025 Bonus Trends

2025 Bonus Trends

The landscape of instant referral bonuses with no deposit has evolved significantly in 2025, with financial institutions, investment platforms, and even gig economy apps leveraging these incentives to attract new users. SoFi, Chase Bank, and Robinhood now offer competitive sign-up bonuses ranging from $50 to $500 for referrals, often tied to simple actions like linking a bank account or making an initial trade—no deposit required. For example, Robinhood’s 2025 promotion includes a cash reward split between referrer and referee, while SoFi rewards users with bonus cash for both banking and investment referrals.

Investment platforms like Coinbase, Charles Schwab, and Wealthfront are also jumping on the trend, offering no-deposit referral bonuses in the form of free stocks, managed portfolio credits, or even fractional shares. Wealthfront’s latest program provides a $50 bonus for referrals who sign up and complete a risk assessment, making it a low-barrier entry for passive income seekers. Meanwhile, Fundrise and Acorns are targeting millennials and Gen Z with real estate investing and micro-investing bonuses, respectively—Acorns’ 2025 referral program includes a $10 instant bonus just for signing up.

Beyond finance, platforms like Coursera, Fiverr, and Dropbox are using referral programs to drive growth. Coursera’s gift card redemption for successful referrals appeals to lifelong learners, while Fiverr’s affiliate marketing model offers cash rewards for bringing in new freelancers or clients. Cloud storage services like Dropbox and web hosting providers like Hostinger have also refined their referral bonus structures—Hostinger’s 2025 program, for instance, rewards users with credits for every paid subscription secured through their referral link.

For those looking for quick earnings, survey and rewards platforms like Survey Junkie, Swagbucks, and InboxDollars remain popular, but newer players like KashKick and Freecash are gaining traction with higher payouts and faster cashback options. KashKick’s 2025 model rewards users not just for referrals but also for completing offers, creating a dual-stream passive income opportunity.

The online gambling and sports betting niches haven’t been left behind. Chumba Casino and LuckyStake are leading with no-deposit casino bonuses, often in the form of free sweeps coins or bonus cash for referred friends. These platforms have fine-tuned their referral programs to comply with 2025 regulations while still offering enticing cash rewards.

Key takeaways for maximizing these trends in 2025:

- Diversify referrals across sectors (finance, gig economy, rewards) to maximize passive income.

- Look for programs with no deposit requirements, like those from SoFi or Acorns, to minimize risk.

- Prioritize platforms with instant payouts (e.g., Swagbucks, Freecash) over those with lengthy processing times.

- Stay updated on mobile banking and investment platforms, as their referral bonuses often fluctuate with market trends.

As competition heats up, expect more platforms to roll out creative discounts and rewards structures—making 2025 an ideal year to capitalize on referral programs across industries.